ChatGPT is a powerful AI-powered language chatbot that may be used for various applications, including research and education. To help you with your study, you can employ informational, instructional, opinion-based, and role-playing prompts. ChatGPT, when used appropriately, may help you understand difficult words, research whitepapers, analyze tokenomics and founder backgrounds, and design a complete crypto study plan.

We will show you examples of using ChatGPT for crypto research and give you some tips and best practices to get the most out of this chatbot. Let’s get started!

What is ChatGPT

ChatGPT is an artificial intelligence chatbot developed by OpenAI that can interact conversationally. It is based on the GPT-3.5 language model, one of the world’s most advanced natural language processing systems. ChatGPT can answer follow-up questions, admit mistakes, challenge incorrect premises, and reject inappropriate requests. It can also follow an instruction in a prompt and provide a detailed response. ChatGPT is available as a web app, an iOS app, and a Chrome extension. You can try it for free at chat.openai.com.

In this article, we will explore the effective ways to use ChatGPT for crypto research. Crypto research gathers and analyzes information about cryptocurrencies, blockchain technology, decentralized applications, and related topics. Crypto research can help investors, developers, regulators, and enthusiasts understand the current trends, opportunities, and challenges in this fast-growing and dynamic field. ChatGPT can be a valuable tool for crypto research because it can:

- Generate summaries of complex or technical topics.

- Provide relevant facts and data from reliable sources.

- Compare and contrast different cryptocurrencies or platforms.

- Explain standard terms and concepts in simple language.

- Suggest interesting or novel ideas or perspectives.

How to use ChatGPT for Crypto Research in effective ways

Quickly discover new projects.

ChatGPT works effectively on summarizing new projects so that you can save a considerable amount of time reading docs and whitepapers of the projects. To use ChatGPT for outlining new crypto projects, you can use a prompt like this:

- Summarize the main features and benefits of [name of crypto project] in 3 sentences.

For example, if you want to summarize the project called Solana, you can write:

- Summarize the main features and benefits of Solana in 3 sentences.

And ChatGPT might respond with something like this:

Solana is a high-performance blockchain that supports fast, scalable, and secure decentralized applications. It uses a novel consensus mechanism called Proof of History, which enables parallel processing and low latency. Solana also offers low fees, interoperability, and a rich ecosystem of tools and projects.

Analyze a project in a fundamental way

To help you write effective prompts for crypto project analysis, you can check out these guides on using ChatGPT for crypto research. They contain examples of prompts for various crypto scenarios and tips on improving them.

Here is a sample prompt that you can use to analyze a crypto project fundamentally:

Prompt: “I have a project on Decentralized Finance (DeFi) called Compound. Can you provide me with a summary of the project goal, the protocol description, the tokenomics, and the competitive advantages?”

Possible ChatGPT output:

Compound aims to create an open, transparent market for lending and borrowing crypto assets. Users can supply their holdings to the protocol and earn or borrow assets by paying interest. The interest rates are determined by supply and demand in each market.

The protocol is built on Ethereum and consists of smart contracts that manage the assets and user interactions. Users interact with the protocol through various interfaces, such as web apps, wallets, or other protocols. The protocol supports multiple assets, such as ETH, DAI, USDC, WBTC, etc.

The native token of Compound is COMP. It is used for governance purposes, allowing token holders to propose and vote on changes to the protocol parameters, such as interest rates, collateral factors, supported assets, etc. COMP is distributed to users who supply or borrow assets on Compound as an incentive to participate in governance.

The competitive advantages of Compound are its simplicity, security, and composability. The protocol is designed to be easy to use and understand for users and developers. Third-party security firms audit the protocol and have a bug bounty program to ensure its safety. Moreover, the protocol is composable with other DeFi protocols, enabling new use cases and innovations.

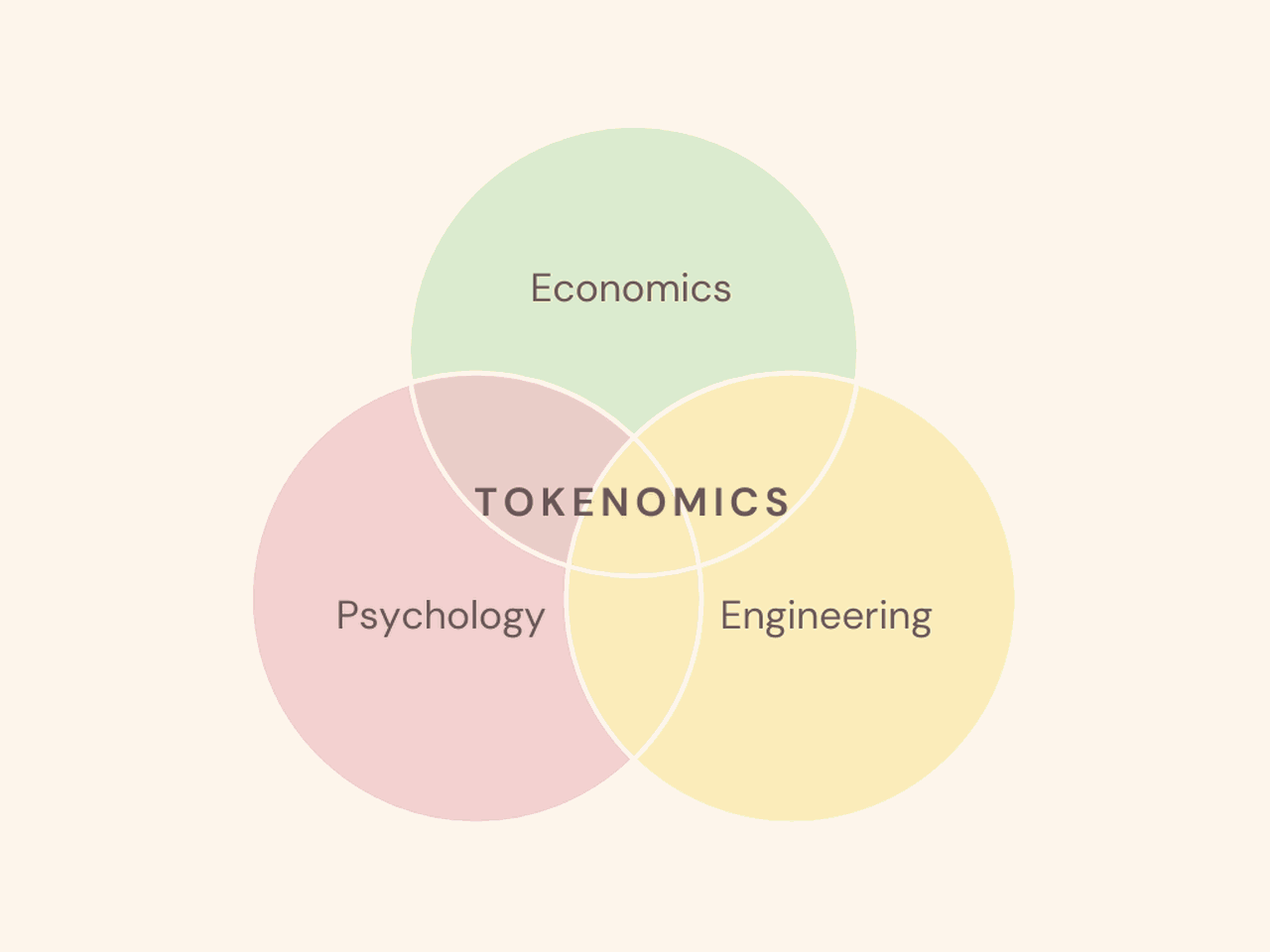

Analyze Tokenomics

Here is a sample prompt that you can use to analyze tokenomics crypto fundamentally:

Prompt: “I have a project on Decentralized Exchange (DEX) called Uniswap. Can you provide me with a summary of the tokenomics of its native token UNI, including its supply and emission schedule, utility and demand, distribution and governance, and valuation?”

Possible ChatGPT output:

The tokenomics of UNI are as follows:

- Supply and emission schedule: UNI has a fixed total supply of 1 billion tokens. 60% of the supply is allocated to the community members, 21.51% to team members and future employees, 17.80% to investors, and 0.69% to advisors. The tokens are vested over four years, with an initial release of 15% at launch and the rest released gradually every month.

- Utility and demand: UNI is used for governance purposes, allowing token holders to propose and vote on changes to the Uniswap protocol parameters, such as fees, liquidity pools, supported assets, etc. UNI also incentivizes liquidity providers (LPs) who stake their tokens in various pools and earn fees and rewards. Moreover, UNI is used as a medium of exchange and store of value within the Uniswap ecosystem and beyond.

- Distribution and governance: UNI has a decentralized and fair distribution model that aims to reward the users and contributors of the Uniswap protocol. 15% of the community allocation was distributed through an airdrop to historical users, LPs, and SOCKS holders in September 2020. The rest is distributed through four liquidity mining programs until May 2021, each allocating 5 million UNI monthly to four pools: ETH/USDT, ETH/USDC, ETH/DAI, and ETH/WBTC. The governance process is initiated by anyone who holds at least 1% of the total UNI supply or delegates their votes to others. A proposal needs at least 4% of the total UNI supply to be submitted for voting. A proposal passes if it has more than 50% of the votes and at least 40 million votes in favor.

- Valuation: UNI is currently valued at $18.76 per token, with a market capitalization of $10.7 billion. This makes it the ninth-largest cryptocurrency by market cap and the most significant DEX token. UNI’s valuation is influenced by several factors, such as the growth and adoption of the Uniswap protocol, the demand for governance rights and liquidity incentives, the competition from other DEXes and centralized exchanges (CEXes), the innovation and development of new features and products, and the overall market sentiment and trends.

Common mistakes when using chatGPT for crypto research

Some common mistakes to avoid when using ChatGPT for crypto research are:

- You are relying solely on ChatGPT for crypto research. ChatGPT is a helpful tool but not a substitute for your research and analysis. ChatGPT can provide information and insights but cannot guarantee its responses’ accuracy, completeness, or timeliness. You should always verify the information and data that ChatGPT provides with other sources and use your judgment and critical thinking when making decisions based on ChatGPT’s output.

- You are asking vague or ambiguous questions to ChatGPT. ChatGPT can handle complex and technical topics but needs to understand what you want it to do. You may get vague or ambiguous answers from ChatGPT if you ask vague or ambiguous questions. Your prompts should be specific and transparent and use keywords and phrases to guide ChatGPT. You can also ask follow-up questions or clarifications to ChatGPT if you are not satisfied with its responses.

- Expecting ChatGPT to know everything about crypto. ChatGPT is a powerful and versatile chatbot, but it is not omniscient. ChatGPT can access information and data from the internet, but it may not be able to answer every question or cover every topic related to crypto. ChatGPT may also have outdated or incomplete information as the crypto field constantly evolves and changes. You should be aware of the limitations and gaps of ChatGPT’s knowledge and seek other sources if ChatGPT cannot answer your question or provide sufficient information.

- Misusing or abusing ChatGPT for crypto research. ChatGPT is a chatbot that can interact conversationally but is not human. ChatGPT can answer follow-up questions, admit its mistakes, challenge incorrect premises, and reject inappropriate requests. Still, it cannot engage in argumentative discussions, emotional support, personal advice, or illegal activities. You should respect ChatGPT’s rules and boundaries and use it for its intended purpose of crypto research. You should also avoid asking for sensitive or confidential information from ChatGPT, as it may not be secure or private.

Other options

There are many chatbots for crypto research, but ChatGPT stands out for its natural language understanding and generation capabilities. ChatGPT can handle complex and technical topics, provide relevant facts and data from reliable sources, compare and contrast different cryptocurrencies or platforms, explain common terms and concepts in simple language, and suggest exciting or novel ideas or perspectives. ChatGPT can also interact in a conversational way, which makes it more engaging and user-friendly than other chatbots.

Some of the other chatbots for crypto research are:

- AlphaChat: A no-code chatbot platform that allows cryptocurrency companies to build natural language understanding bots for customer service automation and lead generation.

- Qualified: A no-code chatbot platform that allows crypto companies to automate their support and sales.

- Engati: A chatbot platform that offers pre-built templates and integrations for crypto-related use cases.

- Chatfuel: A chatbot platform that enables crypto companies to create Facebook Messenger bots without coding.

- Chatbot.com: A chatbot platform that offers a drag-and-drop interface and natural language processing for crypto-related scenarios.

- Ada: A chatbot platform that uses artificial intelligence to provide personalized and proactive support for crypto customers.

- I&C Chat: A chatbot application that uses the Chatterbot library and Itchat API to provide information and real-time quotes for the top 25 cryptocurrencies.

ChatGPT differs from these chatbots in several ways. First, ChatGPT is not limited to a specific channel or platform but can be accessed through a web app, an iOS app, and a Chrome extension.

Second, ChatGPT is not restricted to predefined templates or scenarios but can generate responses based on the user’s input and instruction.

Third, ChatGPT is not only a source of information but also a partner of conversation, which can ask clarifying questions, admit its mistakes, challenge incorrect premises, and reject inappropriate requests.

Fourth, ChatGPT is powered by the GPT-3.5 language model, one of the world’s most advanced natural language processing systems.

Conclusion

ChatGPT is a powerful and versatile tool that can help you with crypto research, such as summarizing new projects, performing fundamental analysis, evaluating tokenomics and governance models, analyzing market trends and valuations, and staying updated with the latest news and developments.

By using effective prompts and instructions, you can leverage ChatGPT’s natural language processing and machine learning capabilities to generate valuable and relevant information and insights.

However, you should always verify the accuracy and reliability of ChatGPT’s output and use it as a supplement rather than a substitute for your own research and judgment. ChatGPT is not a financial advisor and should not be used for direct financial advice.