In the world of cryptocurrency, two important concepts that contribute to trading efficiency and liquidity provision are Market Makers (MMs) and Automated Market Makers (AMMs). While both serve similar purposes, they differ in their approach and functionality. This article aims to provide a clear and comprehensive understanding of Market Makers and Automated Market Makers in the crypto context and highlight the differences between the two.

What is a Market Maker (MM)?

A Market Maker is an entity or individual that plays a crucial role in ensuring liquidity in financial markets, including cryptocurrency. Market Makers actively buy and sell assets, creating a more liquid and efficient trading environment. They accomplish this by continuously quoting bid and ask prices for specific assets, establishing a spread between the buying and selling prices. The Market Maker profits from this spread and compensates for the risks associated with providing liquidity.

How do Market Makers (MM) make profits?

In traditional financial markets, Market Makers (MMs) primarily seek profits through the spread.

The spread, also known as the Bid-Ask Spread, represents the price difference between the buying (Bid) and selling (Ask) prices of a financial instrument at a specific moment. While some exchanges claim to have zero commission fees, these fees are typically incorporated into the spread.

For instance: When an investor purchases a stock on an exchange, they may observe a Bid price of $99 and an Ask price of $101.

This indicates that the broker buys the stock at $100 and subsequently sells it to potential buyers at $101. Even a slight difference in the spread can yield substantial daily profits through high-volume trading.

Understanding the dynamics of spreads is crucial for Market Makers in traditional financial markets as it directly affects their profitability. By efficiently managing spreads, Market Makers can capitalize on the discrepancies between buying and selling prices, generating revenue through their intermediary role.

What is an Automated Market Maker (AMM) in Crypto?

Automated Market Makers (AMMs) are automated tools that use algorithms to determine asset prices and facilitate trading. Unlike traditional Market Makers (MMs), AMMs operate on smart contracts and rely on liquidity pools. Traders can directly interact with these pools to buy and sell assets without the need for intermediaries. AMMs have gained popularity in the crypto industry for their decentralized nature, accessibility, and ability to provide liquidity for various digital assets.

AMMs offer a more efficient and cost-effective trading experience compared to traditional exchanges. By automating the market-making process, AMMs eliminate the need for order books and enable users to trade directly against the liquidity pool. This results in faster transaction settlements, lower fees, and increased liquidity. AMMs have revolutionized market creation in the crypto space, allowing anyone to participate in trading and providing a flexible and streamlined trading environment for users.

How liquidity providers profit in AMMs

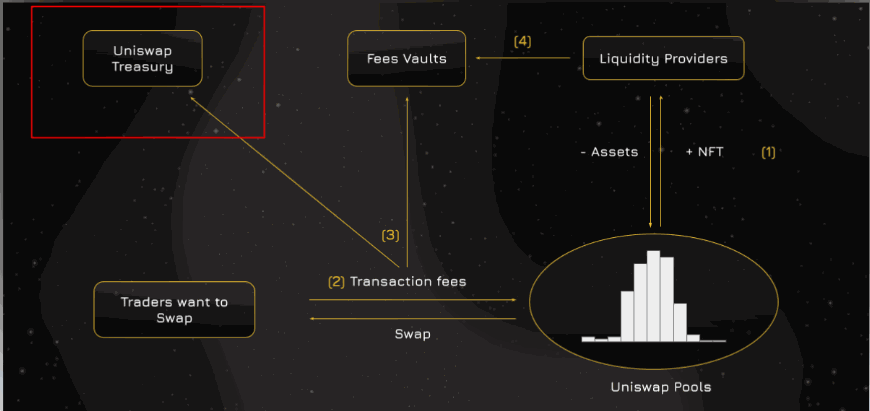

Liquidity providers play a crucial role in the AMM ecosystem and have the opportunity to earn profits. By depositing their digital assets into liquidity pools, they enable trading within the AMM. In return for providing liquidity, they receive a share of the trading fees generated by the AMM.

However, liquidity providers also face risks. They are exposed to price fluctuations of the tokens they provide liquidity for, which can result in losses. Additionally, they bear the risk of impermanent loss, which occurs when the value of the assets in the liquidity pool deviates from the external market price.

To compensate for these risks, liquidity providers are rewarded with a portion of the trading fees. For example, in Uniswap, the trading fees of 0.3% are distributed proportionally among the liquidity providers in the pool.

By participating as liquidity providers, individuals can earn passive income through the fees generated by the AMM. This incentivizes liquidity provision and helps ensure the availability of liquidity for traders in the AMM ecosystem.

Two Key Differences between Market Makers (MMs) and Automated Market Makers (AMMs)

- AMM as a Preferred Liquidity Solution for Long-Tail Assets (LTAs)

In essence, both MM and AMM can provide liquidity for any asset in the market, but in reality, very few professional MMs are willing to create markets for LTAs due to the following reasons:

- Low and unsustainable trading volume.

- High price volatility.

- MMs primarily operate for profit, so creating markets for LTAs does not offer high-profit potential, and the risks are higher than popular assets. Therefore, LTAs are not the optimal choice for MMs.

- On the other hand, in the Crypto market, you don’t need a professional MM to create a market for your token because anyone, including yourself, can create a market for any token on Permissionless AMMs. Hence, at the moment, AMM is a better liquidity solution for LTAs in the Crypto market compared to MM.

- Transaction fees

A notable difference between markets created by MM and AMM is the transaction fees. From a user’s perspective, the transaction fees on MM-created markets are significantly lower than those on AMM-created markets. You can see this difference by comparing the fee structures of exchanges like Binance and Uniswap:

- The standard trading fee on Binance is 0.1%, while Uniswap charges a 0.3% fee.

- Exchanges like FTX have much lower trading fees than Binance, ranging from 0.02% to 0.07%. This mainly stems from the risk involved in providing liquidity to these markets. In AMM model-generated markets, liquidity providers bear much higher risks than those in MM-generated markets.

Therefore, if the fee is set too low, the incentive for liquidity providers in AMMs will also be low, resulting in these AMM-generated markets being unable to attract potential liquidity providers.

Conclusion

Market Makers and Automated Market Makers play distinct roles in the cryptocurrency market. Market Makers are centralized entities that actively manage trading activities, while Automated Market Makers utilize decentralized protocols and algorithms for automated trading and liquidity provision. Both contribute to the growth and stability of the crypto market, offering opportunities for traders and liquidity providers. Understanding their differences is crucial for navigating the evolving landscape of crypto trading.