This article will introduce you to a product of MEXC, ETF. In the traditional financial market, this is a popular financial derivative. MEXC will support various trading pairs of ETF products.

EFT can be new and difficult for some beginners in the Crypto market in terms of both trading methods and mechanisms. This article will partly help you better understand ETFs. Read it now.

What is a Leveraged ETF?

ETF is a derivative product that tracks the price movement of a certain asset by a certain multiple with a margin of 2 to 5 times that asset. Leveraged ETFs make tokens more profitable than regular tokens in Spot trading.

You can instantly trade ETF products on the MEXC Spot Market. ETF products help you to amplify your assets without margin and without worrying about any liquidation risk.

Token EFT

How EFT tokens appear: Token Name + Leverage + Long/Short

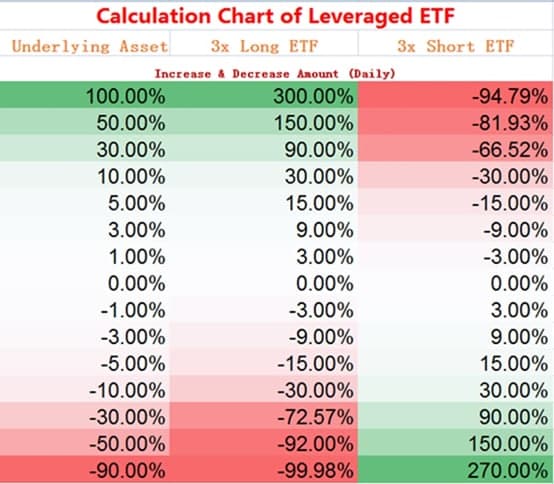

If the underlying price increases by 10%, the net value of the 3-times leveraged ETF product will increase or decrease by 30%.

Example: If you predict the Bitcoin price will increase in the near future and you buy 100 USD BTC3L (BTC 3x Long). After that, BTC increases by 10%, your profit will be 30% (because of x3 leverage), and your investment will now be 130 USD. If BTC drops 10%, you will lose 30 USD, and your investment is only 70 USD.

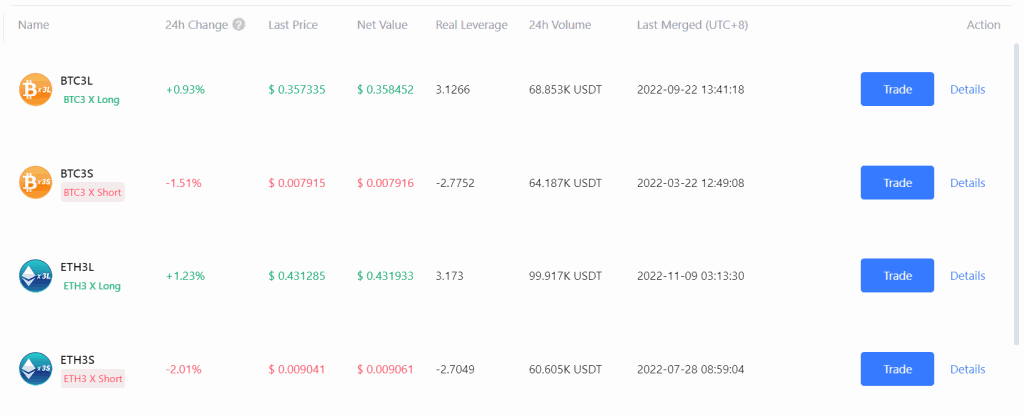

Symbols (for example, Bitcoin)

- BTC3L: BTC 3x Long

- BTC3S: BTC 3x Short

In general, the mechanism of an ETF is that a stock fund is tied to the return of an underlying asset. Fund managers will rebalance the fund composition to maintain targeted leverage when the underlying assets fluctuate against a leveraged ETF beyond a certain threshold.

Coin price

The coin price on the ETF will be different from the Spot price, the ETF coin price is the constant that the MEXC floor system has calculated based on the base price of each coin.

Currently, there are many basic coins with integrated leveraged ETFs with leverage ranging from x2 to x5, depending on the coin.

Differences between Leveraged ETF and Margin Futures

In fact, ETFs are similar to margin futures, but ETFs have a few more unique features:

- No deposit is required, account transfer, lending, or debt repayment.

- Low risk of liquidation.

- Buying/selling an ETF is as easy as buying/selling a spot. For example, if you want to buy BTC3L, look at the price and net worth => enter the purchase amount => and choose to buy BTC3L without any other operation.

- Fixed leverage (leverage of ETF products is essentially constant).

Special Features of ETFs on MEXC

No deposit fee

Like regular Spot trading, Leveraged Tokens ETF can be bought/sold with USDT. So investors can buy/sell on the secondary market without paying any deposit.

Various options

Hundreds of ETF products are trading on MEXC, and the products all support 3x leverage. Some other products have 2-5x leverage.

Compound interest effect

Leveraged ETF will automatically convert position profits to principal. If the purchased leveraged ETF generates a floating profit*, the floating profit will be added to the token value and continue to accrue, thus making the ETF position leveraged on the next rebalancing increased, creating a compound interest model.

*Floating profit is not fixed, changes continuously, and fluctuates according to the market situation.

Example: After you buy 100 USD BTC3L and get 30% profit (equivalent to 30 USD) on the first day. After 23 hours (the time of the periodic rebalancing every day), the exchange will add a profit of 30 USD to the principal. That means on the second day, your principal will be 130 USD.

If Bitcoin goes up 10% again on Monday, your $130 investment will increase by 30% and be worth $169. So after 2 days, Bitcoin price only increased by 20% but thanks to leveraged ETF and compounding effect, your investment increased by 69%.

But if Bitcoin drops 10% on the second day, your $130 principal will lose 30% of its value and be reduced to only $91.

Eliminate the risk of liquidation.

The S-type ETF will automatically rebalance to help you minimize your losses and avoid liquidation risk.

For example, if you buy BTC3L and then BTC drops 33%. Instead of your long position being liquidated with a leveraged ETF, that won’t happen.

Leveraged ETFs will decrease according to market conditions and adjust positions through a rebalancing mechanism to prevent positions from being liquidated. Even if the BTC price drops 33%, your position will still exist.

However, when the market is highly volatile, the ETF rebalancing mechanism can also cause portfolio loss to a certain extent.

Low transaction fees

ETFs have relatively low transaction fees compared to holding Futures or Margin contracts of the same value:

Transaction fee: 0.2%

- Daily management fee: 0.001%

High discount rate

Community leaders can receive discounts, referral rewards, and high trading rewards through the all-player cashback program.

Mechanism of ETF

Periodic rebalancing

At 4:00 pm UTC daily, MEXC will rebalance positions every 24 hours.

Rebalancing according to price fluctuations

To protect the interests of investors and avoid the fund’s net worth and token price plummeting, the fund has established an unusual rebalancing mechanism due to price fluctuations. When a user’s assets are lost to a certain extent, the ETF product will automatically adjust the leverage to the original leverage level and partially reduce the position to avoid liquidation risk.

This mechanism ensures that the net worth of the fund and the value of the tokens will not return to zero and that the losses of investors who choose the wrong direction can be controlled within a certain range.

The figure above shows the rebalancing metric according to the price movements of all assets. For example, if Bitcoin gains 30% (3rd row), BTC3L will increase 300%. Meanwhile, the price movement rebalancing mechanism will be applied to BTC3S. Instead of a 300% drop, BTC3S will only drop 66.52%

Merge Mechanism

The platform will conduct token consolidation when the price of the net worth is below a certain threshold. The price of the net worth will be 10 times lower before the merge, and the corresponding number of tokens will also be reduced to 1/10 of the amount before the merge.

The user’s total assets will not be affected. The consolidation is intended to improve the sensitivity of price changes and optimize the trading experience.

Why lose tokens when trading ETFs?

After a period of trading, your tokens may be lost for unknown reasons, which is discussed in the “Mechanism of consolidation” section. When the price of a coin falls below a certain level (specifically, 0.1 USD), this mechanism will take place.

For example:

On July 15th, you buy 100 USD DOT5L at 0.12 USD and get 1000 DOT5L.

On July 17, the DOT price increased, but a wick was pulling below the $0.045 level.

Right now, your DOT tokens will be reduced to 100 DOT5L (1/10 of the original coins), while the price of DOT5L increases to 0.5 USD (10 times from the price of 0.05 USD – a certain level set by the exchange, which corresponds to the definition that “the price of net worth will be 10 times higher before consolidation.” (Read the “consolidation mechanism” section again”).

So after the merge, the price of DOT5L will be 0.5 USD, and the amount of DOT5L will be 100 tokens. So your asset value does not change because buying at 0.12 USD and the price falling to 0.045 USD, you have lost 50% of the price regardless of coin consolidation or not.

And after pulling the wick to $0.045, the price rises again, and your asset will increase again.

So, thanks to the consolidation mechanism, when the price fell to $0.045, your account was not burned but could also be profitable on the next price increase.

How to trade ETFs effectively?

To maximize profits in this type of trading, you need to know the following:

Leveraged ETFs are only beneficial for short-term trading.

- You must have a solid market analysis background and the ability to judge the short-term trend of the market highly accurately.

- Avoid management fees by buying/selling before 4:00 pm UTC every day.

- ETFs are unsuitable for inexperienced and undisciplined traders due to the market’s high volatility.

Risks of trading ETFs

Not suitable for long-term holding as you incur daily management fees, position rebalancing, and other wear and tear fees.

- When the deficit is high, the slow recovery will automatically reduce the position: When the market is volatile, the ETF token balance system will be activated to minimize the risk. However, when the market reverses immediately after the rebalancing, the recovery of losses will slow down as the initial position declines.

- When trading, you need to check the token’s net worth: you should be careful not to let the order price differ too much from the net value of the token so as not to lose.

- Don’t track accumulated multi-day gains and losses. When the market fluctuates several times a day, a capital loss can result because leveraged ETFs only track intraday multiples of the rate of return.

ETF Talent Program

This program was created to provide more quality services to players and help the community to become more aware of the brand while allowing more people to experience ETF products.

Have no less than 500 members in the Telegram community or no less than 500 social media followers. (More than 10% of active people in the tele community)

- You must have a personal trading volume of 100,000 USDT or more every month

See program details here.

MEXC ETF Information

ETF Information & Latest Events

Conclude

As can be seen, ETFs are quite suitable for investors to increase assets in a clearly trending market quickly. However, ETFs are suitable for short-term transactions and should not be held too long to avoid asset loss and management fees.

Hopefully, with the above knowledge and examples, you can understand the leveraged ETF trading on MEXC with important notes. Wish you successful trading and reap a lot of profits.