In this article, let’s discuss an investment strategy called DCA, Dollar-Cost Averaging, what it is, how it works, and When should we use a DCA strategy; what are the pros and cons of this strategy? Here are some must-know notes when DCA in Crypto.

What is DCA?

DCA (Dollar-Cost Averaging) is an investment cost-averaging strategy known as the price-averaging strategy. This is an investment strategy to reduce the impact of price fluctuations on asset purchases.

Simply put, DCA divides the investment amount into different parts instead of investing all the capital. In the long run, such a strategy reduces the negative impact of a wrong entry on your investment. This is a popular financial investment strategy, especially in the crypto market, which is highly volatile.

How does the DCA strategy work?

Let’s look at this strategy through an example:

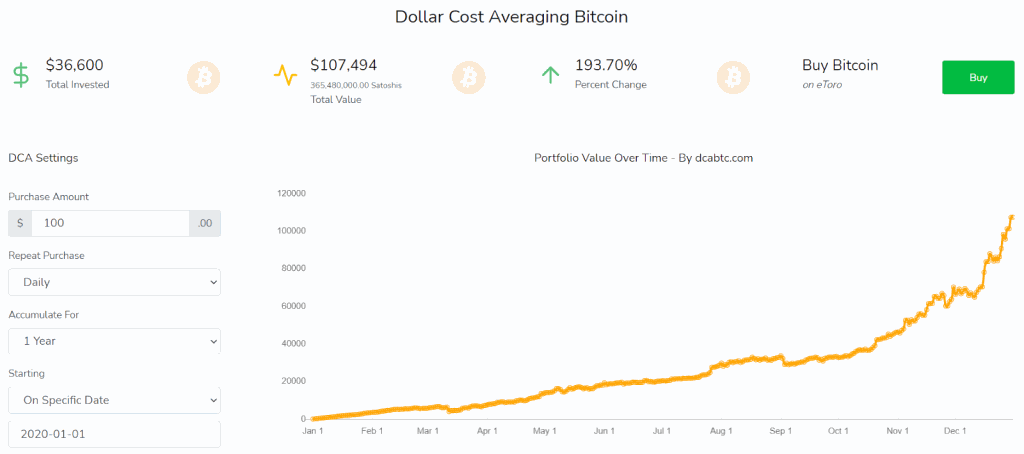

Resume that Billy has a fixed amount of $50,000, and Billy thinks investing in Bitcoin is reasonable. Billy believes the price will likely fluctuate in the current zone, and this is a favorable area to accumulate and build a position using the DCA strategy.

Billy can divide $50,000 into 500 parts, $100 each. Billy will buy $100 worth of Bitcoins daily, regardless of the price. In this way, Billy will extend his entry over about 15 months.

If Billy had started in early 2020, he would have had a decent return of nearly x3 assets in 1 year.

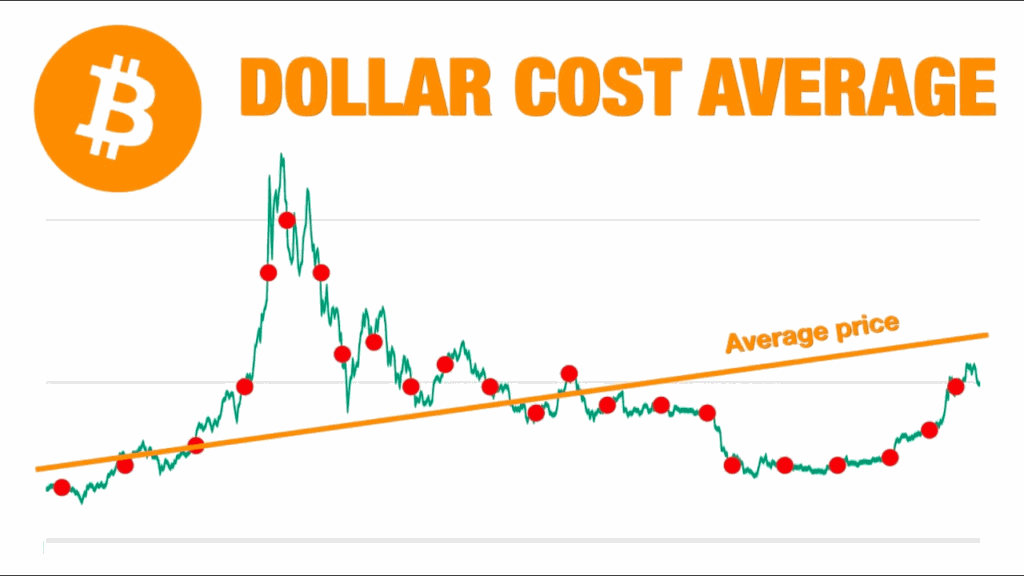

The above visual example shows that the cost-averaging strategy’s main benefit is reducing the risk of investing at the wrong time. Market timing is one of the most elusive things regarding trading or investing.

Often, even if you have the right trade direction, the timing of the investment can still be skewed, which makes the entire trade inaccurate. The price averaging strategy helps to mitigate this risk.

If you divide your investment into smaller chunks, the investment results can be better than if you invest the same amount in several bulk purchases. Buying at the wrong time is very easy to happen, and it leads to unsatisfactory investment results.

Furthermore, you can remove some biases from your decision-making process. When you commit to a cost-averaging strategy, it will decide for you.

The DCA strategy aims to buy and hold a position long enough that timing is no longer critical. In addition, if you have considered using the cost-averaging strategy of investing in a position, you should also set up an exit plan for yourself.

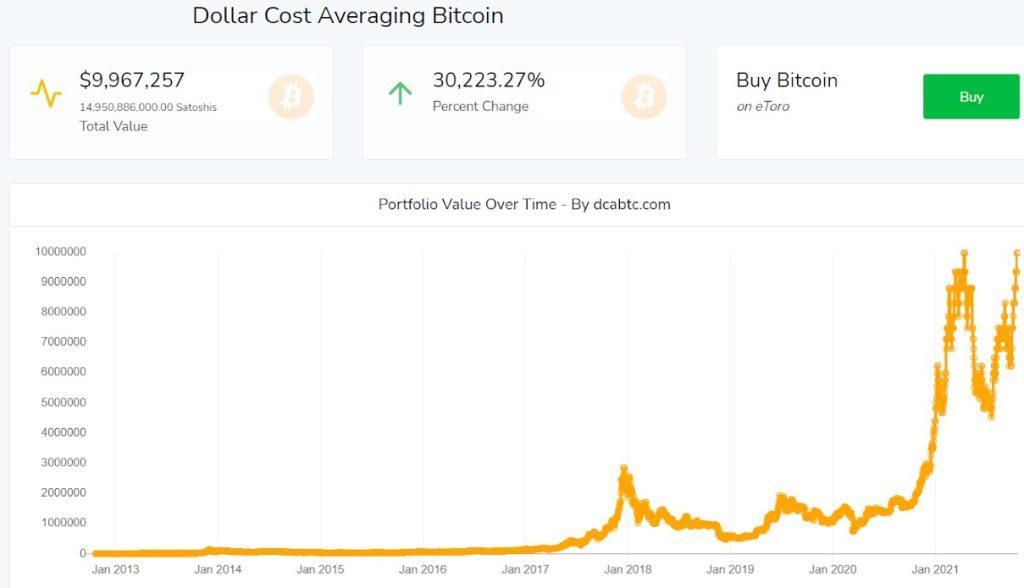

In the case of BTC, despite periods of recession, BTC remains in a continuous uptrend.

Of course, averaging investment costs does not entirely reduce risk. This strategy aims to reduce the risk of bad times, making the investment smoother. An investment cost-averaging strategy does not guarantee successful investment; basic research is needed in this regard.

Pros and cons of DCA strategy

Advantages

The DCA strategy is advantageous because of its easy implementation. If you are new to Crypto investing, this is an excellent way to start because you have less to react to price changes.

Using the DCA strategy, investors do not need to search for the best time to invest and still get a relative profit, as long as the correct long-term trend is identified. They need to define a regular investment amount and schedule and start the process.

Disadvantages

While DCA can help you avoid some bad buying decisions, sticking to the DCA strategy can sometimes cause you to miss out on great opportunities to make big profits (for example, a substantial Dump) in the crypto market in March 2020).

The DCA strategy is aimed at the middle level. So, DCA is not the best strategy for investors looking to make the most of price changes.

When the DCA strategy should not be used

If the market is in a sustained uptrend, it can be assumed that those who invest earlier will get better results. In this regard, attempting to average investment costs can reduce returns in a sustained uptrend. In this case, a one-time investment may be better than cost averaging, as shown below.

On the other hand, investment cost averaging (DCA) only works well when the primary trend of the underlying asset is bullish over the long term. If you misidentify, this strategy will not bring you the desired profit.

03 notes to know when using DCA strategy

Here are three notes for you when using the price averaging (DCA) strategy:

The price averaging strategy is only suitable for spot trading; people are not recommended to average prices in Margin, Future and other leveraged financial products because of the high risk and possibility of account burnout.

In Crypto, if you choose coins & tokens with a bad foundation or implement a DCA strategy in a long-term Downtrend (8 – 10 years), price averaging can suck your capital more and make you wait in the future—a long time. Therefore, analyzing the market and identifying the primary trend is one of the main factors to help you successfully implement the DCA strategy.

To minimize risk, you should balance managing capital. When investing anything, if it has reached the take profit or stop loss level that you have set, you need to stop immediately. Do not be greedy or regret too much.

Summary

Dollar Cost Averaging (DCA) is a popular investment strategy that minimizes the impact of price fluctuations on an investment. The main benefit of using this strategy is its effectiveness in the long run. Timing the market is tough, so those who do not want to monitor the market actively can still invest this way.