As we all know, Know Your Customer (KYC) and Anti-Money Laundering (AML) are two common concepts every trader can quickly encounter when participating in finance activities, especially in the cryptocurrency market.

So, how important are KYC and AML to traders, what is the status of KYC and AML, and what preparations do entities involved in financial activities need to prepare to complete KYC and AML procedures? Answered in the article below!

What is KYC?

KYC – “Know Your Customer” – Customer identification or understanding customers is a procedure to identify and verify customer identity is correct with what they have declared. In financial trading, this process includes checks performed in the early stages when the broker contacts the customer (trader) to verify that the client is genuine.

Verification is done through matching information from identity documents (ID card, identification card, driver’s license, …) and primarily through the direct presence of the customer. KYC verification is a mandatory condition that traders need to perform to participate in financial activities such as trading forex and cryptocurrencies and participating in some Coin ICO projects.

KYC protects both the broker and the trader and explicitly helps the broker determine the client’s risk tolerance, investment knowledge, and financial situation. Those financial institutions must verify the identity of each customer, monitor their transactions, and report suspicious activity, such as sudden increases in deposits or withdrawals. Here, KYC means knowing the customer’s identity and understanding their typical transactions and behavior.

For example, Exchange A allows global citizens to use the service, but Exchange B does not provide services to citizens in countries such as the United States, Canada… At this point, exchanges A and B only need to filter—the nationality of each user based on the KYC information collected. The authorities can investigate or track wrongdoing based on the KYC process’s database.

What is AML?

Today’s methods of money laundering (Money Laundering) – Money laundering is the practice of concealing illegally earned money in order to make the source of funds “appear” legitimate – The process of turning “dirty” money into “clean” money or the act of turning illegal income into assets through extremely sophisticated commercial transactions with the backing of high technology.

So, Anti-money Laundering (AML) is a set of laws, regulations, and procedures that aim to prevent money laundering criminals by preventing illicit funds from entering the financial system. AML regulations require banks and financial institutions that provide credit or accept customer deposits to follow rules that ensure they do not support money laundering.

Difference between KYC and AML

KYC, as mentioned, is just the process of verifying the customer’s identity. Its primary purpose is to understand your clients and their financial transactions better, thereby managing risk effectively.

While an AML program includes the following:

- – KYC Procedures: Customer Due Diligence – Customer Due Diligence (CDD) and Enhanced Due Diligence – Enhanced Due Diligence (EDD);

- – Risk-based AML policies;

- – Ongoing risk assessment and ongoing monitoring;

- – AML compliance training programs for employees;

- – Internal Control and Internal Audit.

Customer Due Diligence – Customer Due Diligence (CDD) is a basic KYC process where customer data such as identity and address data is collected and used to assess a customer’s risk profile.

Enhanced Due Diligence – Enhanced Due Diligence (EDD) is an improved KYC procedure for high-risk customers. Typically, clients classified as high-risk after a CDD review are prone to money laundering and terrorist financing. Therefore, this group is regulated and monitored according to its own regulatory norm.

The EDD procedure includes verification of Ultimate Beneficial Ownership (UBO) and politically exposed persons (PEP) information. Transaction Monitoring is also a key element of EDD.

A financial institution should create AML policies by its country’s AML rules and regulations—laws like the US Bank Secrecy Act and the EU’s 4th Anti-Money Laundering Directive. AML and KYC regulations vary from country to country; however, they are all based on gathering enough information for identity verification and ensuring their activities are legitimate.

The importance of KYC and AML in trading activities

KYC and AML prevent illegal activities and protect customers.

KYC and AML processes are often complicated and expensive. Since then, many users have thought that these regulations should be removed. However, knowing how dangerous money laundering is will make you less likely to complain about these somewhat cumbersome processes.

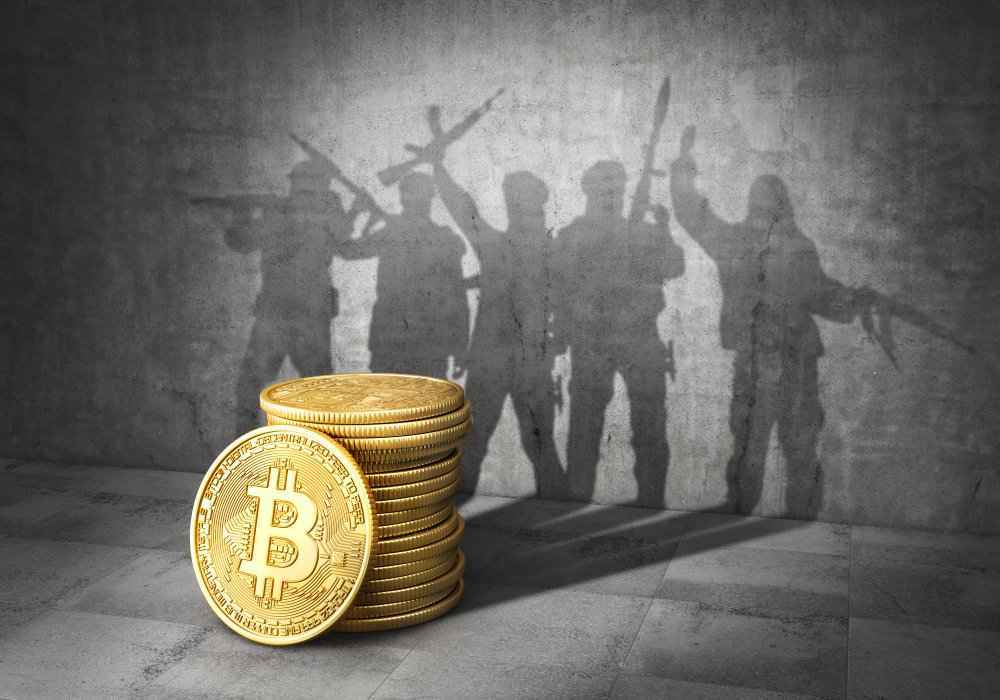

The subjects involved in everyday money laundering activities are smugglers (drugs, weapons, etc.), corrupt people, terrorist organizations, etc., to turn “dirty money” into “clean money.”

They will use all means to introduce into the financial system money, which is converted to other forms or transferred to other institutions through different transactions and financial instruments to make money appear “legitimate” to come from a formal source. The money is fed back into the financial system by purchasing assets to move them into the legitimate economy.

From a macro point of view, dirty money and money laundering profoundly affect income distribution, such as creating injustice and shaking society’s edibility in financial markets. Criminals use money laundering to hide their crimes and money. Financial institutions play a vital role in the world of financial crime. Financial crime will continue increasing if institutions fail to comply with regulations.

Therefore, even in the first step of putting dirty money into the financial system, namely banks or exchanges, their illegal actions will be prevented immediately through KYC and AML regulations.

KYC is the most critical factor in online platforms, primarily virtual currency trading. In addition, KYC also creates a database of information that law enforcement can use in their investigations in the case of certain criminal activities in the future.

Meanwhile, Anti-money Laundering laws and regulations target criminal activities, including market manipulation, illegal goods trade, corruption of public funds, tax evasion, and activities aimed at concealment of these actions.

Law enforcement money laundering investigations often scrutinize financial records for inconsistencies or suspicious activity. So, when the police try to track down the perpetrator of a crime, there is hardly a more effective method than checking the records of the financial transactions in which the person is involved.

For traders, providing KYC information is necessary for your account to upgrade to a trading level.

Imagine that a terrorist has just made 1 million dollars in cash after a bombing in Afghanistan. He wants to transfer 200k USD to his girlfriend, who sells weapons in Africa. Of course, these two subjects are extremists, are desired, and their bank accounts are frozen. He thought of a way to transfer this 1 million USD into Bitcoin. Blockchain is anonymous; no one knows who he is in these transactions.

Wait, so it’s that simple for him? 1 million dollars earned from murder is transferred to arms dealers to continue to cause further deaths for others?

The answer is N; things are not so simple for him. To change USD into Bitcoin on the exchange, he needs to perform KYC to verify his identity and ensure his account will be Banned from the beginning because it is on the Blacklist. And the behind-the-scenes transactions will no longer be possible. Currently, KYC and AML fulfill their role in preventing “dirty money” from being given to “bad people.”

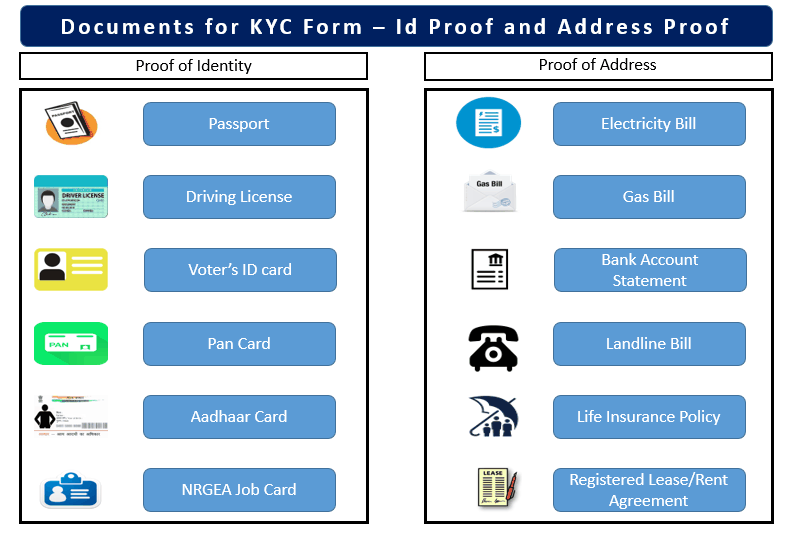

What documents are required for successful KYC identity verification?

So how do we – ordinary users, do KYC, AML? Have you ever encountered a case of performing identity verification for an ICO project or registering an exchange, but registering forever could not due to failed KYC? Below I will list a list of documents required to perform KYC:

- ID includes National Identity Card (ID card), citizen identification, or Passport (Passport).

- Driver’s liDriver’sany exchanges or ICO projects can substitute for ID)

- Provide Full Name, Name as required as in ID/Passport

- Documents certifying your residence are valid withinthree3 months, which may include: electricity and water bills, TV bills, Internet bills…

- Income declaration: You need to show proof of income from where you got it. This ensures you are not spending “dirty money” on that for exchange. Whether each ICO project/exchange requires it or not.

With the above documents, ICO projects or exchanges often ask us to provide a photo or scan and submit it. Some projects also require users to “take a selfie” holding an ID card or Passport.

After you have submitted all the required documents, they will check the information by comparing the information you have previously registered with the information on the submitted manuscript. This KYC identity verification process usually takes 1-2 business days. Depending on the ICO project or different exchange, they will require additional documents and authentication time.

Conclude

The KYC process may take up less time for “brokers” and “traders,” but you will be trading in a safer environment in return.

Illegal financial activities, especially money laundering, have significantly impacted the financial system’s safety and national economy. Therefore, anti-money laundering (Anti-money Laundering) and KYC processes are essential tasks. The AML process may be complicated and expensive and has also raised questions about its effectiveness, but ensuring a transparent and secure financial system is still necessary.

Follow BTAGuru to update the latest Cryptocurrency news.