In cryptocurrency, liquidity is crucial in determining the ease with which digital assets can be bought or sold without significantly affecting their prices. As a seasoned content writer with three years of experience, this article aims to provide a professional and detailed explanation of liquidity in cryptocurrency. By exploring the concept from different angles and giving specific examples, readers will understand liquidity comprehensively and its significance in the crypto market.

What Is Liquidity?

Financial Liquidity

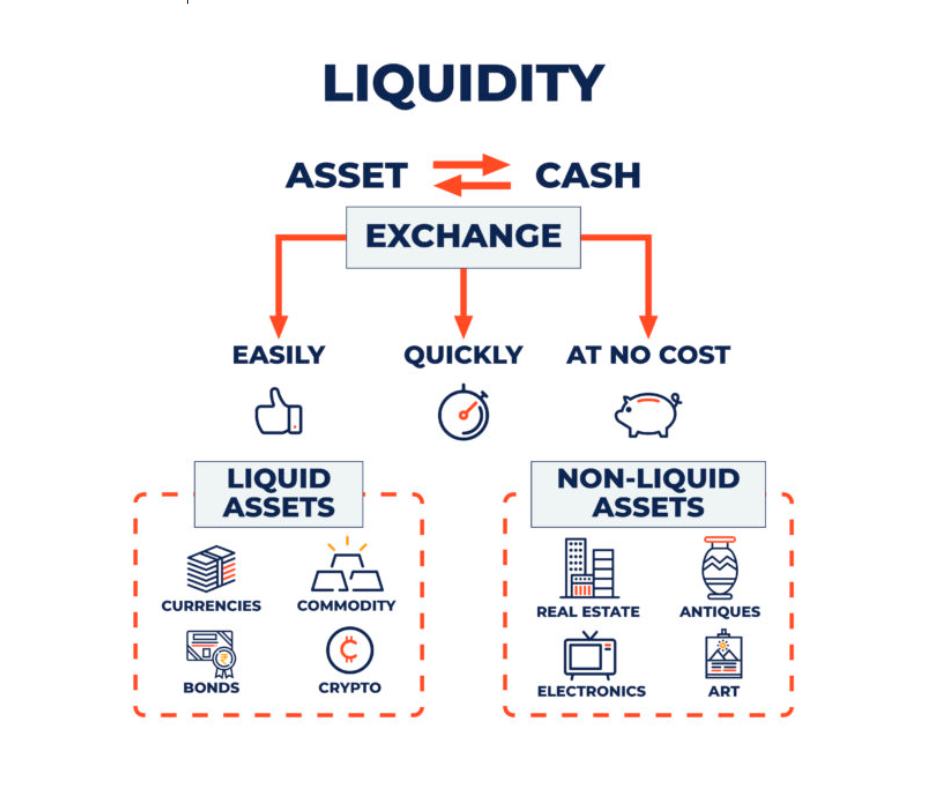

Financial liquidity is the ability to convert cryptocurrencies into cash quickly and effortlessly. It determines how easily an investor can buy or sell digital assets. While some cryptocurrencies, like Bitcoin and Ethereum, are highly liquid and comparable to cash equivalents, such as US treasuries, others may exhibit varying degrees of liquidity.

Factors influencing financial liquidity include market demand, trading volume, and the ease of conversion from digital assets to cash. Cryptocurrencies with high liquidity allow investors to enter or exit positions without significantly impacting the market price.

Market Liquidity

Market liquidity pertains to a market’s ability to facilitate smooth and efficient transactions between buyers and sellers without causing drastic shifts in the comparative value of the assets. Liquidity can vary across different markets and trading pairs within cryptocurrency exchanges.

Several factors influence market liquidity, including the popularity of a particular crypto asset, trading volume, and the size of the exchange. Markets with higher liquidity are generally associated with better price stability, reduced volatility, and more participants willing to trade.

Example of Liquidity

Here are some examples of high liquidity assets in real life. One of them is gold. You can buy or sell gold anywhere, not necessarily at gold shops. Gold is highly liquid due to its perceived value and wide acceptance by the general population.

Another example is cash. If you pay attention, we buy and sell cash daily by exchanging it for other goods and services. Therefore, cash is an asset with highly high liquidity.

On the other hand, there are assets with low or limited liquidity, such as real estate, antiques, furniture, and art. These assets are not easily converted into cash or may require longer to find a buyer. As a result, their liquidity is considered low.

The Fundamental Aspect of Liquidity

At its core, liquidity entails the delicate balance between the speed of transactions and the potential impact on prices.

- In cryptocurrencies with high liquidity, this balance is minimal. It means that executing large-volume buy or sell orders swiftly has a negligible effect on the cryptocurrency’s price.

- Conversely, lower-liquid cryptocurrencies exhibit a higher impact when executing such trades.

Allow me to provide a more illustrative example:

Let’s say you purchase Coin A at $1 per unit with a volume of $100,000. After one month, the value of Coin A rises to $10. Your investment has now yielded a 10-fold profit of $1 million.

However, the available buy volume at the $10 price level is limited, with only $100,000 orders. To sell the entire $1 million worth of Coin A, you need to consider a price range between $10 and $9, where sufficient volume can be found.

If you decide to realize your profits immediately, you must trade off 10% and sell at the $9 price level. Doing so can expedite selling your entire holdings, minimizing the waiting time to near-instantaneous.

By understanding the essence of liquidity, investors can evaluate the ease of executing transactions and the potential impact on prices. This knowledge is valuable for practical trading strategies, risk management, and decision-making processes in the cryptocurrency market.

The Importance of Liquidity

Liquidity holds immense importance in investments and is a critical factor that investors thoroughly evaluate before engaging in any market. Particularly in developing markets like cryptocurrency, liquidity often poses challenges for large-scale investors seeking entry.

Liquidity directly impacts prices, leading to a divergence between anticipated and actual returns on a specific cryptocurrency.

Consider a scenario where you hold a substantial amount of Token B and have enjoyed a 30% profit. You swiftly sell Token B to capitalize on that 30% gain. Unfortunately, Token B suffers from a lack of liquidity. If you opt for immediate liquidity, you might incur a loss of around 50%, eroding your 30% profit and resulting in a 35% loss. Alternatively, if you aim to sell while preserving the 30% profit, you must invest considerable time in finding buyers at that price. However, it is essential to remember that the market does not solely revolve around your trading decisions. If you choose not to sell, others will be willing to sell, exerting downward pressure on the price.

Consequently, opting for highly liquid cryptocurrencies remains prudent for investors with significant capital.

By comprehending the significance of liquidity, investors can make informed decisions, mitigate risks effectively, and confidently navigate the cryptocurrency market.

Factors Affecting Liquidity

Three key factors influence liquidity in cryptocurrency:

- Project Popularity

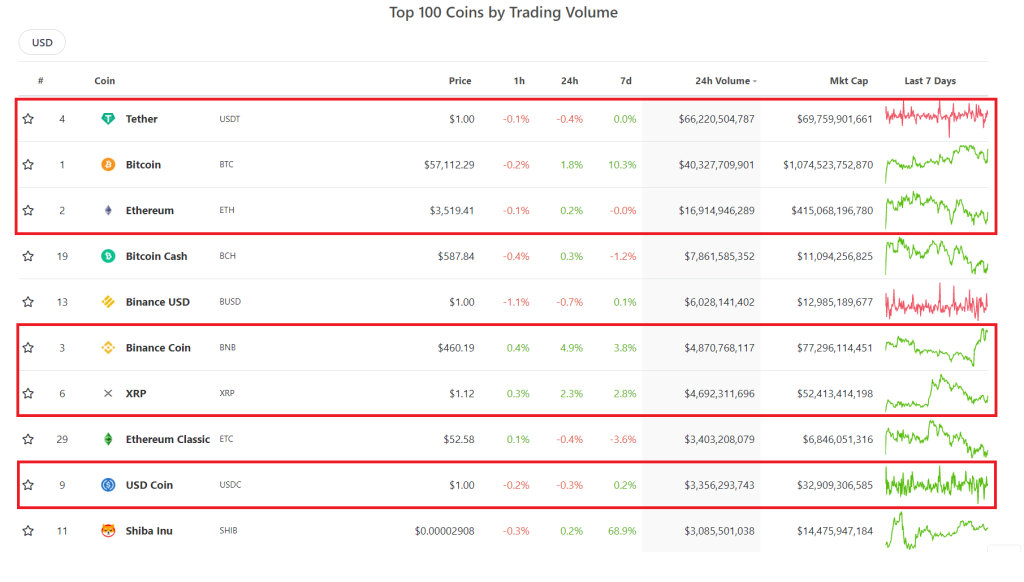

The popularity of a project plays a crucial role in determining its liquidity. A widely recognized and highly regarded cryptocurrency is likely to attract a more significant number of traders and investors. For example, among the top 10 cryptocurrencies by market capitalization, it is common to find coins that rank highly in daily trading volume. This popularity creates a vibrant market where buying and selling activities are more frequent.

- Community Hype

Community hype refers to excitement and attention surrounding a particular cryptocurrency. While a broad consensus drives popularity, community hype can sometimes emerge for lesser-known assets.

For instance, when Dogecoin (DOGE) experienced a surge in popularity, it sparked interest in other meme-inspired tokens, such as Shiba Inu (SHIB). This sudden influx of attention led to increased trading volume and liquidity for SHIB, resulting in its inclusion among the top coins by trading volume.

- Project Reputation

The reputation of a cryptocurrency project plays a significant role in determining its liquidity. Projects with a strong track record, transparent communication, and a history of delivering on their promises tend to enjoy higher liquidity. This is because investors and traders are more willing to engage with projects they perceive as trustworthy and reliable. A reputable project garners confidence and interest from the community, leading to increased liquidity and a more active market.

These three factors collectively contribute to the liquidity of a cryptocurrency. By understanding the interplay between project popularity, community hype, and project reputation, investors can make informed decisions and navigate the cryptocurrency market more effectively.

Benefits of High Liquidity in Cryptocurrency

High liquidity in the cryptocurrency market offers several advantages for traders and investors. Here are some key benefits:

- Price Stability and Fair Trading Environment:

High liquidity ensures a fair trading environment where prices remain stable. With maximum trading participation, traders can buy and sell coins at competitive prices. This reduces the risk of losses and increases the likelihood of generating profits. A liquid market discourages price manipulation by individuals or entities with significant capital, as continuous trading helps maintain price stability.

- Protection from Market Manipulation:

In a less liquid market or exchange, traders are vulnerable to market manipulation by entities with significant financial resources. However, exchanges with high liquidity are better equipped to withstand such activities. With many participants trading actively, the prices are less susceptible to manipulation, providing a more secure trading environment.

- Fast Transaction Execution:

High liquidity enables lightning-fast transaction execution. Traders can quickly buy or sell coins, crucial for capitalizing on market opportunities and maximizing profit margins. Rapid transaction execution also helps trade analysts accurately predict cryptocurrency prices based on real-time market data.

- Enhanced Market Analysis:

A highly liquid market provides ample trading data, allowing analysts to conduct in-depth market analysis. The availability of comprehensive and reliable market data enables traders to make informed decisions and develop effective trading strategies. It also facilitates accurate price predictions and improves understanding of market dynamics.

High liquidity in the cryptocurrency market offers stability, protection against market manipulation, fast transaction execution, and valuable market insights. These benefits create a favorable environment for traders, enhance trading efficiency, and contribute to the overall growth and maturity of the cryptocurrency ecosystem.

How to Assess the Liquidity of Cryptocurrencies

As we have discussed, liquidity is crucial in making informed trading decisions. It reflects the ease of buying, selling, entering, or exiting cryptocurrency.

Before engaging in any cryptocurrency transaction, it is essential to assess the liquidity of the coin by considering the following three factors:

24-Hour Trading Volume:

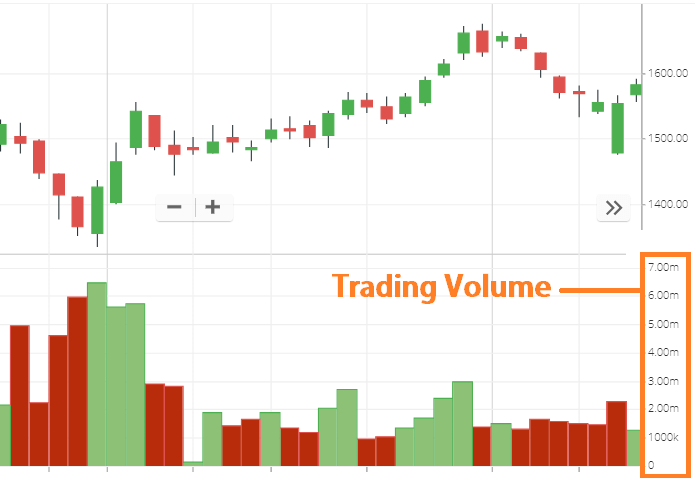

The trading volume provides insights into the liquidity of the market and historical trading data. It helps in predicting price behavior in the future.

You can use platforms like Coinmarketcap, CoinGecko,…. to check the 24-hour trading volume of the cryptocurrency you intend to trade.

Remember that this is the total trading volume, so you should determine which exchange has the highest trading volume for that particular coin. Additionally, be cautious of exchanges involved in fake volume or wash trading practices, as trading quickly on such platforms can be challenging due to the dominance of trading bots.

Order Book Depth

After identifying a reliable exchange with genuine trading volume, you should examine the order book depth for the specific cryptocurrency.

This helps estimate the liquidity level for immediate trading with your desired volume.

For example: If you want to sell 100,000 units of Coin A for $0.1, and the Buy Order Book Depth indicates:

- Only $40,000 worth of Coin A is available at $0.1.

- An additional 60,000 units of Coin A are available at $0.09.

This information lets you assess the potential price difference when trading with different liquidity levels.

Bid-Ask Spread

The Bid-Ask Spread represents the difference between the highest bid and the lowest ask price in the order book. A higher Bid-Ask Spread indicates inferior liquidity and vice versa.

For instance, consider the Bid-Ask price of the DOGE/PAX pair on the Binance exchange. You can observe that the closest buy order for DOGE is at 0.0025293 PAX, while the closest sell order is at 0.0026798 PAX.

If you execute a buy order for DOGE at 0.0026798 PAX and can only sell it at 0.0025293 PAX, you would incur a loss of approximately 6%.

In addition, various factors can affect liquidity. By looking at these liquidity metrics, traders can make more informed decisions and navigate the crypto market more confidently.

Liquidity Pool and Liquidity Mining in Cryptocurrency

Liquidity Pool and Liquidity Mining are concepts that emerged in the cryptocurrency space, particularly with the advent of Decentralized Finance (DeFi) in the late 2020s.

A Liquidity Pool refers to a pool of liquidity within Automated Market Maker (AMM) platforms or lending projects, where users can deposit their assets to provide liquidity for others to trade. Projects offer benefits such as a portion of transaction fees or additional project tokens as rewards for liquidity providers to incentivize users to contribute their support.

Providing liquidity and earning rewards through these programs is known as Liquidity Mining. The main objective of Liquidity Mining is to attract more liquidity into AMMs, ensuring that high-value trades are executed without significant price slippage. In the case of lending projects, Liquidity Mining encourages users to participate in borrowing and lending activities.

By participating in Liquidity Mining, users contribute to the stability and efficiency of the decentralized financial ecosystem while earning rewards for their participation.

Liquidity Pool and Liquidity Mining have played a significant role in the growth and development of DeFi, fostering liquidity and expanding the range of financial services available in the cryptocurrency space.

In summary, Liquidity Pool and Liquidity Mining are innovative mechanisms that incentivize users to contribute liquidity to decentralized platforms, ensuring smoother and more efficient trading experiences while earning rewards for their participation.

Should you invest in a coin with high or low liquidity?

If you are considering a significant investment, choosing a project with high liquidity is generally advisable. This is because high liquidity reduces the risk of substantial price slippage. Imagine a scenario where you place a large order that causes the asset’s price to increase by nearly 5%. In such a case, substantial sell pressure is more likely.

However, what if you come across a project with great potential but low liquidity? There are two approaches to address this issue:

- Split your order into smaller parts: By dividing a large order into multiple smaller orders, you can manage your purchases while considering the coin’s price movement. You can decide whether to continuously buy regularly or wait for price dips to accumulate more.

- Choose a high-liquidity decentralized exchange (DEX) platform: Opt for DEX platforms with high liquidity, such as SushiSwap or Uniswap. These platforms have a larger pool of available liquidity, which can help mitigate the impact of larger orders on price movements.

Regarding investing, selecting projects with high liquidity is generally preferable, especially for significant investments. However, if you encounter a project with low liquidity that you believe has great potential, you can manage the situation by splitting your orders or utilizing high-liquidity DEX platforms.

Conclusion

Liquidity plays a vital role in the success and development of any market. The cryptocurrency market is no exception, as it continues to face challenges related to liquidity, deterring traditional investors from fully embracing its potential.

Investors must recognize the significance of liquidity when selecting cryptocurrencies to trade. Investing in illiquid coins can lead to difficulties executing transactions and potentially hinder profit-making opportunities.

By understanding the importance of liquidity and conducting thorough research, investors can make informed decisions and navigate the cryptocurrency market more effectively.