What is Slippage? What are the causes of price slippage? Here are three solutions to avoid or minimize slippage when trading cryptocurrencies!

Have you ever executed a swap order on an AMM exchange and received a slightly lower (or much lower) amount than expected? One of the reasons for this is slippage.

What is Slippage?

Slippage refers to the difference between the theoretical price on the exchange and the actual price you have to pay. Slippage commonly occurs when trading on AMM DEX exchanges due to factors such as low liquidity and front-running by bots.

When executing a trade on AMMs, traders incur two types of losses:

- The protocol charges Transaction fees (e.g., Uniswap charges a 0.3% fee, while PancakeSwap charges a 0.2% fee).

- Slippage.

For example: If you execute a trade with $1,000 to buy 5 BNB at a price of $200/BNB. After deducting the 0.2% protocol fee:

- According to the theoretical price, you should receive nearly 5 BNB.

- However, in reality, you only receive 4.7 BNB.

- The difference of approximately 0.3 BNB is the slippage.

What are the causes of price slippage?

Three main factors contribute to slippage:

Market volatility

When the market experiences significant fluctuations in price, characterized by both upward and downward movements, it creates an environment of heightened trading activity, with investors eagerly entering orders to capitalize on potential opportunities. This increased participation and competition among market participants contribute to the overall volatility and unpredictability of price movements during these periods.

For example: If you intend to sell ETH at $2,000 but someone else sells before you at a lower price due to low gas fees, the price of ETH may drop to $1,950 or $1,900. As a result, your order is executed at a lower price.

Insufficient Liquidity in the Market

A similar issue arises when trading on centralized exchanges (CEX), where the available Buy and Sell orders may only involve a small amount of a particular asset. This can become problematic when attempting to execute a large trade all at once, such as selling 1,000 ETH. In such cases, the sudden increase in selling pressure can cause a significant decline in the asset’s price.

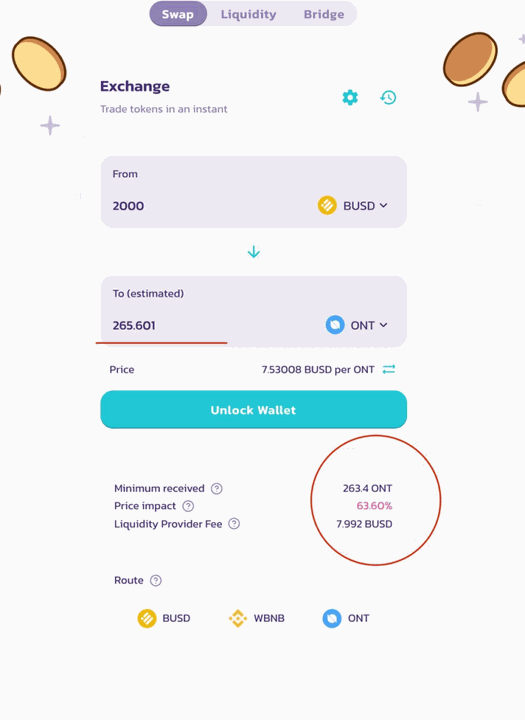

Similarly, Automated Market Makers (AMMs) rely on liquidity pools to facilitate trades. If the available liquidity in these pools is insufficient compared to the trade size, the overall liquidity will decrease significantly.

For instance, let’s consider a specific example involving the BUSD – ONT trading pair. Suppose you intend to swap 2,000 BUSD for ONT. On a traditional exchange, $2,000 may not be substantial. However, on PancakeSwap, the liquidity pool for ONT may be limited, resulting in a slippage of 64% for your trade. Consequently, this situation does not favor those seeking to purchase ONT on PancakeSwap.

Front Running Bot

Front-running bots exploit their knowledge of forthcoming trades that can impact market prices. These bots engage in a manipulative practice known as front-running, which aims to profit from the resulting slippage. Here’s a breakdown of the process:

- Front-running bots identify trades with significant slippage potential and price impact that can generate profits.

- They strategically place a buy order of an appropriate size and volume ahead of the user’s trade, considering that a buy order itself can influence the price.

- The bots swiftly sell their position once the user’s order is executed. Their profitability lies in the slippage caused by the user’s trade, enabling them to buy at a lower price and quickly sell at a higher price.

Overall, front-running bots take advantage of their advanced knowledge to gain unfair advantages in the market, exploiting price fluctuations caused by unsuspecting traders.

Why Slippage Matters?

Understanding slippage is crucial as it can significantly impact your trading success. Let’s consider a scenario where a trader places a large market order for a specific cryptocurrency. During the execution of the trade, the price of the cryptocurrency may move unfavorably against the trader. Consequently, the trader may receive a lower price than anticipated, resulting in substantial losses.

Slippage also affects trading costs, as higher slippage translates to increased expenses. Furthermore, delays in order execution caused by slippage can lead to missed opportunities for traders.

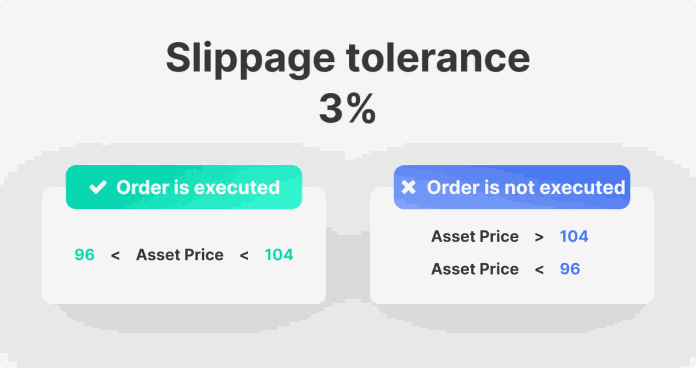

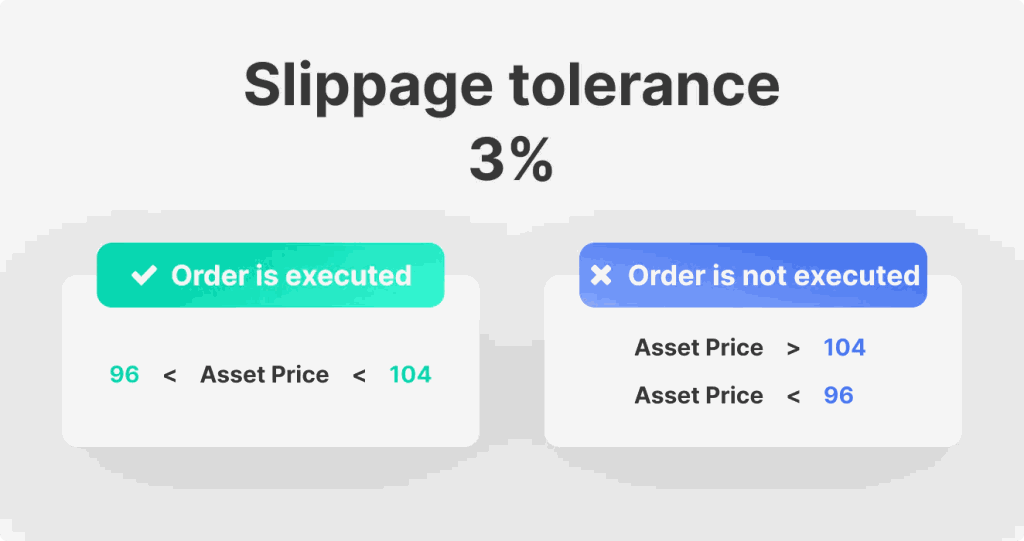

When engaging in cryptocurrency trading, it is important to consider your slippage tolerance. Slippage tolerance refers to the maximum acceptable price difference a trader tolerates to execute a trade. This tolerance should be carefully evaluated to enable traders to accurately assess the potential rewards and risks associated with their trades. Generally, higher slippage tolerance entails a greater risk of losses due to slippage.

Selecting an appropriate level of slippage tolerance requires careful consideration, considering factors such as market conditions and trading strategies. In volatile markets, trades may necessitate a higher degree of slippage tolerance to ensure quick and efficient execution.

Conversely, during periods of lower volatility, it may be possible to set lower levels of slippage tolerance, resulting in more favorable trade executions. Therefore, adjusting the slippage tolerance levels according to current market conditions is essential. Understanding and managing slippage tolerance can empower traders to make informed decisions when entering or exiting trades, thereby enhancing overall trading performance.

Calculating slippage can be challenging, but it is essential to grasp in order to maximize profits and minimize losses. Now, let’s delve into how to calculate slippage when trading in the cryptocurrency market.

Fast Fact: Slippage is an inherent characteristic of all markets, including stocks, forex, and cryptocurrencies. However, slippage can be particularly concerning in the crypto market due to its exceptional volatility.

How to Calculate Slippage

Slippage can be calculated by determining the difference between the current market price and the executed trade price. The calculation is straightforward: Slippage = Current Market Price – Executed Trade Price.

For instance, if you placed a buy order for 1 Bitcoin at $10,000 and it was filled at $9,800, your slippage would amount to $200 (10,000 – 9,800). In this case, slippage occurred because you received a lower price than expected.

Slippage can also be expressed as a percentage by dividing the slippage amount by the current market price. The calculation for the slippage percentage is

Slippage Percentage = (Current Market Price – Executed Trade Price) / Current Market Price.

Slippage Percentage Formula

Continuing with the previous example, the slippage of $200 (10,000 – 9,800) would result in a slippage percentage of 2% (200/10,000). This signifies that the actual executed price deviated by 2% from the expected price due to slippage.

It is important to note that slippage can positively or negatively affect traders, as discussed earlier. In the example provided, the trader incurred losses because they received a lower price than anticipated. However, if the market had moved in the trader’s favor before the trade was executed, they would have experienced positive slippage, receiving a better price than expected.

Fortunately, various tools and resources are available to assist traders in calculating slippage. Many cryptocurrency trading platforms offer slippage calculators that enable users to input their trade parameters and estimate the potential slippage.

Additionally, online slippage calculators are available for free, allowing individuals to assess their potential order execution costs. These calculators utilize real-time market data to estimate the slippage associated with trades, providing traders with valuable insights into potential risks before executing their trades.

Overall, slippage can significantly impact traders’ profits and losses. Fortunately, there are strategies that traders can employ to mitigate the impact of slippage. Let’s explore some of these strategies further.

4 Strategies to Mitigate Slippage in Crypto Trading

To minimize slippage when trading cryptocurrencies, consider the following approaches:

Avoid Trading During High Market Volatility

During periods of intense market fluctuations, such as when macroeconomic events or significant news impact the crypto market, it is prudent to refrain from trading. High volatility often leads to erratic price movements, increasing the likelihood of slippage. Wait for the market to stabilize before executing your trades.

For example: when significant macroeconomic news, such as interest rate changes by the Federal Reserve, is expected to impact the price of BTC, it is advisable to limit trading to avoid slippage caused by volatile market conditions.

Adjust Slippage Tolerance and Monitor Price Impact

Adjust the slippage tolerance setting to reflect your risk appetite when trading on decentralized exchanges (DEXs) or automated market makers (AMMs). This allows you to set an acceptable range for slippage. Additionally, keep an eye on the price impact metric, which indicates the potential price shift caused by your trade. Higher price impact implies greater slippage, so opt for liquidity pools with lower price impact to minimize the risk of slippage.

For example: If the current slippage is 1%, selecting a “Slippage tolerance” of 5% would set the slippage range between -4% and 6%. The transaction will be halted if the actual slippage exceeds this range due to significant market fluctuations during the waiting period.

Additionally, paying attention to the price impact metric can help you avoid trades with excessive slippage. A high price impact indicates that you are trading a substantial amount relative to the liquidity provided by the pool. In such cases, it is advisable to seek alternative pools for trading.

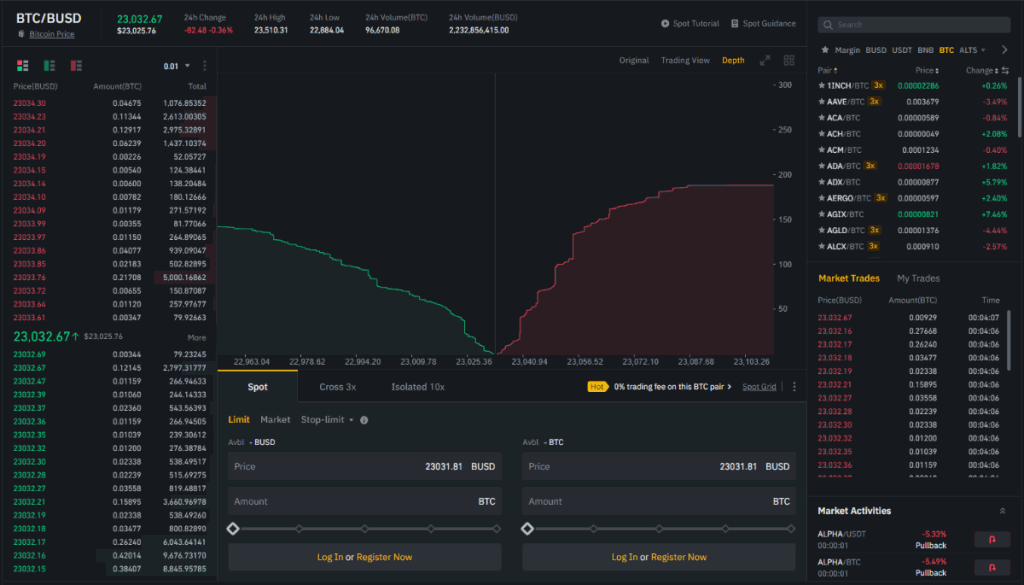

For CEX platforms, traders can monitor the degree of slippage in the “Depth” option as depicted in the image below:

Consider OTC Trading

OTC (Over The Counter) is a term used to describe private transactions for buying or selling cryptocurrencies outside of regular exchange platforms without a public order book.

As OTC trades are conducted through negotiated agreements and are not listed on exchange order books, they are less susceptible to slippage if both the buyer and seller agree on the price and quantity of transacted coins.

While OTC trading is uncommon among retail investors, it is a prevalent method for high-net-worth individuals (whales) with multimillion-dollar assets. They resort to OTC trading when exchange liquidity is insufficient to meet their needs.

Utilize DEX Aggregators or Perform Manual Comparisons

- DEX Aggregators operate by comparing multiple DEX platforms to identify Liquidity Pools with the highest liquidity. They calculate and provide the most optimal routes to minimize slippage. Popular DEX Aggregators include 1Inch, Matcha, and OpenOcean.

However, DEX Aggregators have limitations, such as the inability to compare tokens across different chains and the lack of integration with Bridges to facilitate comprehensive DeFi trading for users. Therefore, traders may need to compare options in less common chains or tokens manually.

By employing these strategies, you can enhance your trading experience and reduce the potential impact of slippage when executing crypto transactions.